Economic Relief & Residential Loans During the Covid 19 Pandemic

During these challenging times when most businesses in Mammoth Lakes are closed and people are requested to stay at home to prevent the spread of one disaster, the expansion of another disaster looms on the horizon; economic disaster.

Each day a business is closed, the likelihood of that business opening again diminishes rapidly. An employer’s ability to maintain employees without revenue is not sustainable and an employees ability to pay their mortgage becomes similarly unsustainable.

There are Loan Relief Programs Available for Businesses

Paycheck Protection Program (PPP):

The PPP Loan is available through your local lender that participates is SBA loans. The application process is relatively simple, so don’t be discouraged.

First Read the PPP Fact Sheet available at the U.S. Treasury website.

Below are some facts related to the PPP Program:

• First day the loans were available through Bank of America there were 66K applications

• Bank of America applications for loan amount made up 10% of the available $349B funds

• As of April 7, 2020 it is rumored more funds may come available to businesses

• Loans are based on a first come first serve basis

While many banks have the ability to issue funds to borrowers and the ability to service the loans, banks have expressed concern over exceeding banking reserve requirements. On April 7th, the Federal Reserve promised to act as a backstop for economic stimulus loans, protecting banks for essentially from breaking the rules.

• Loan interest rates were originally going to be set at .5%, but were later raised to 1%

• Banks want to see 4% interest to make the loans profitable as .5% was below the break even point

• PPP on the loans are permitted deferments of up to 6 months

• Companies applying for PPP loans must have 500 or fewer employees and must maintain employees and their pay prior to the Covid 19 Crisis.

Economic Injury and Disaster Relief Loan (EIDL)

The EIDL loan covers payroll assistance as well as other Economic Injury. Visit this link for an overview of the EIDL Loan.

• The EIDL is different than PPP Loan. You cannot have two loans for the same coverage

• Covers more than just payroll, but a variety of economic losses

• $10,000 advance available for applicants while loan is in process, but available of funds still not known. The advance is forgivable.

• Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic.

• Includes sole proprietorship, independent contractors and self-employed persons, private non-profit organization or 501(c)(19) veterans organizations affected by COVID-19

Economic relief loans are available to Independent Contractors. This is something that has not historically been available. Although it is not really clear how to apply Independent Contractors to the payroll on the the application, or if 1099 payments are forgivable, the plan does call for relief to these individuals.

Because the loan may take some time to process, the government is offering a $10,000 advance to applicants. This government claims this advance will be issued within days of the application. This said, but I’ve not heard of anyone receiving their advance within a few days.

Residential Loans (link from Realtor.com)

Due to the rapid rise in unemployment stemming from the Covid 19 Pandemic, many residential borrowers have requested mortgage forbearance from their lenders. Forbearance allows borrowers to miss several months of payments if they’re suffering a hardship and their mortgage servicer has approved it. But that money is typically due in a lump sum at the end of the forbearance period (currently May 31st in California).

Borrowers must call their respective lenders and lenders are required to provide forbearance, however there is an issue for the banks. Banks have not been given forbearance by the bondholders from whom they borrowed funds. In short, banks are not getting paid by their borrowers yet still have to pay bond holders… banks run risk out of exhausting liquidity and even going into default themselves.

• Loan forbearance request were up about 1,270% in from March 2 to Mach 16th. 1,876% from Mid March to April

• Forbearance request as of April 7, 2020 represent 22.4 Million loans… Not $22.4 Million in loans

• Lends the question, is the bankruptcy rate going to increase in coming months?

• MBA’s (Mortgage Bankers Association) believes these figures will continue to skyrocket at unsustainable rates

• Last month Federal Housing Finance Agency allowed up to 12 months of forbearance.

• Waiting times to talk with lender is reported to be up to 5 hours. When trying to discuss a refinance with my lender – JP Morgan Chase, I was personally given a 26 hour wait time.

• Moody’s Mark Zandi, Chief Economist for Moody’s Analytics, anticipates that about 15 million homeowners will receive mortgage forbearance. For perspective that is about 30% of all Residential Mortgages.

• Zandi went on to say this could result in significant credit problems down the line. My response is ” No Shit”

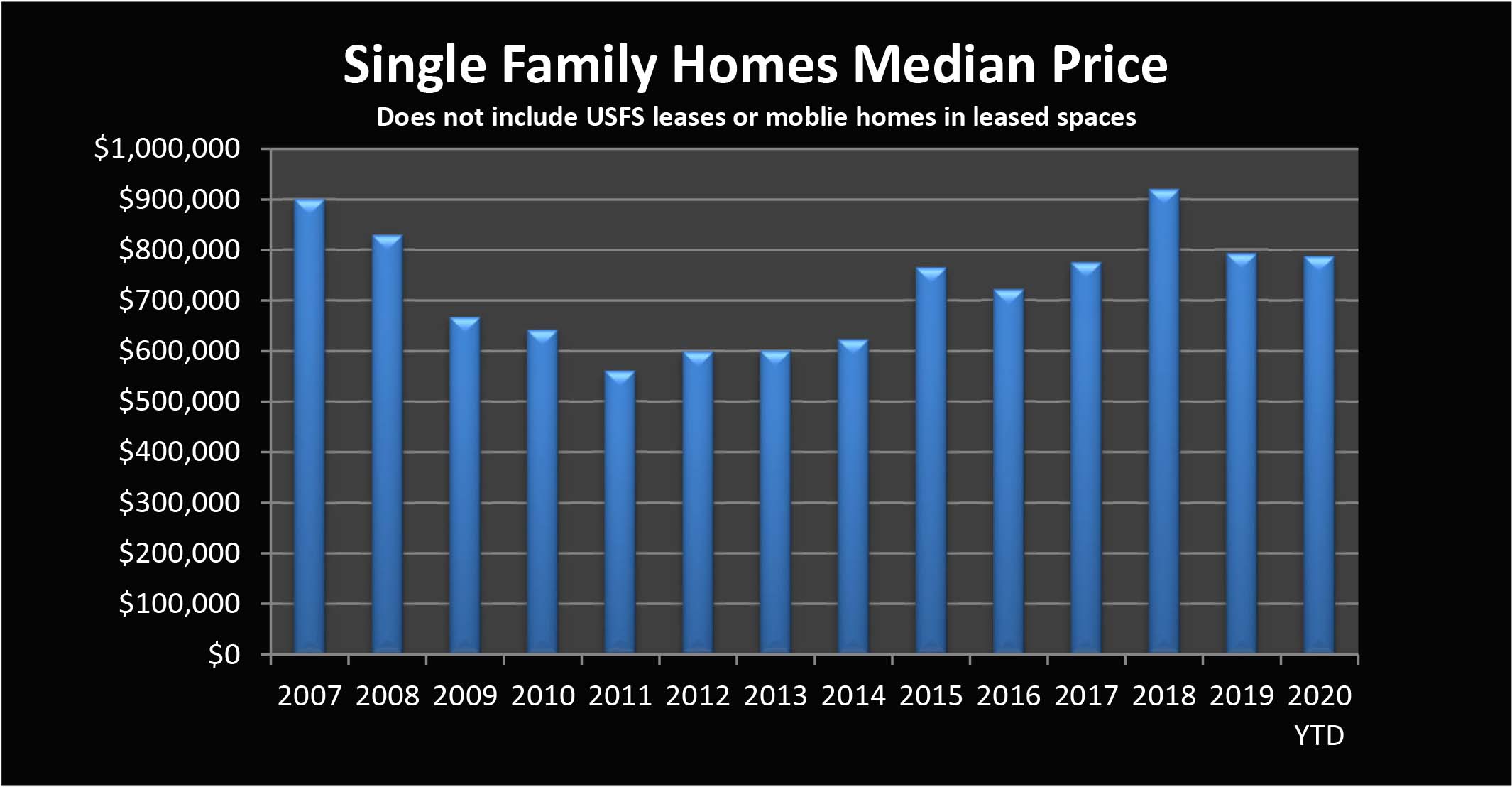

Here is some information on the real estate Market in Mammoth Lakes as of April, 2020.

Here is some information on the real estate Market in Mammoth Lakes as of April, 2020.

If you would like to be updated on our Mammoth Lakes Market Report, just let us know and we will email it to you.